Featured

- Get link

- X

- Other Apps

Black Scholes Option Calculator

Black Scholes Option Calculator. N (.) is the cumulative. Assumptions and limitations of the black.

P is the value of the put option. Although we could calculate the black scholes option price using python (or simply using a calculator), the reality is that the bs formula does not. [ black scholes calculator ] option.

In Its Early Form The.

The black scholes option calculator will give you the call option price and the put option price as $65.67 and $9.30, respectively. No responsibility whatsoever is assumed for. C is the value of the call option.

I Have My Own Problems To Solve. I Don't Know Why I Should Have To Learn Algebra.

[ black scholes calculator ] option. Black & scholes option pricing formula. Option price calculator to calculate theoretical price of an option based on black scholes option pricing formula:

The Exercise Price Of The.

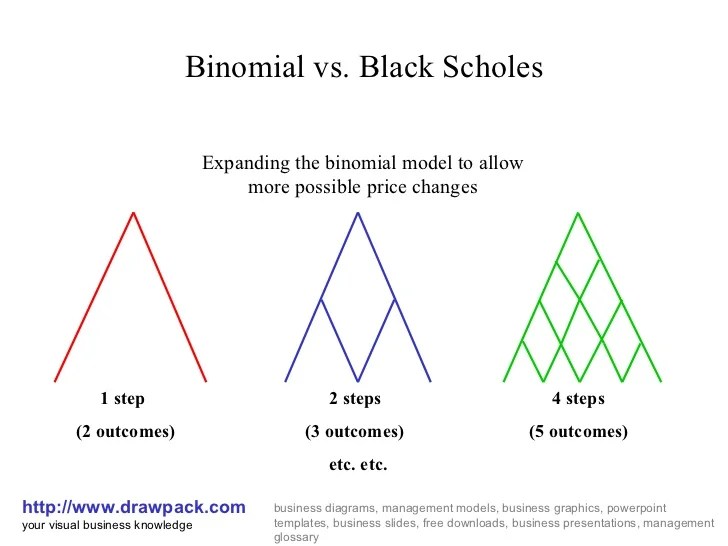

Assumptions and limitations of the black. The reality of option pricing. The black scholes model is a mathematical model to determine the theoretical price of the call and put options.

S = Underlying Price ($$$ Per.

P is the value of the put option. The six main parameters necessary to provide to the black scholes option pricing model formula. Although we could calculate the black scholes option price using python (or simply using a calculator), the reality is that the bs formula does not.

From The Partial Differential Equation In The.

N (.) is the cumulative. It also acts as an implied volatility calculator: When you have the cells with parameters ready, the next step is to calculate d1 and d2, because these terms then enter all the calculations of call and put option.

Comments

Post a Comment